What is so special about successful traders, what sets them apart from the rest? Well, we all know sad statistics - 95% of traders fail. So what makes these 5% different?

We have all heard of such reasons as experience, discipline and strategy. Although these are the main factors, there are other, less obvious ones, which often remain in the background.

The bottom line is that successful traders think differently than the other 95%. They are not interested in a high percentage of profitable trades. They don`t try to trade every day regardless of market conditions.

In this article, we will talk about the main qualities of successful traders, let’s see.

Successful traders:

- Are losing money - No trader can avoid losses. Most beginners consider their losses something bad. But really, losses are a way of showing you that you did something wrong. So when you are losing money, think about what you could improve in your trading.

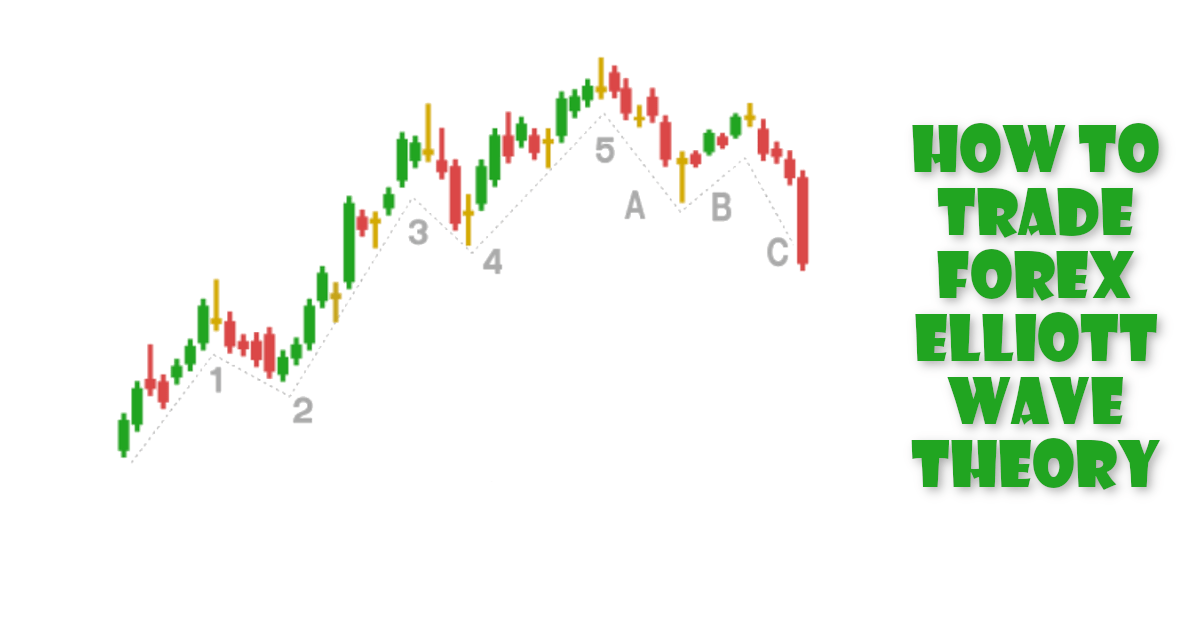

- Use price action - Price action gives you an insight into the psychology of the market and allows you to understand other traders. To become a successful trader, it is important to have an idea of where buy or sell orders are located, where support and resistance levels are placed, where it is best to set stop loss and take profit.

- Have a trade advantage - It is a combination of timeframes, trading strategies, key levels of your risk/reward ratio, and a host of other factors. Even your attitude to P&L plays a role. How do you deal with losses? What do you do when you make a profit? All these things put together make up your trading advantage.

- Always think about the possible risks - Any professional trader always calculates his risks before opening a new position. Most often, this is because they use a certain percentage to calculate risk, such as 1 or 2 percent of their deposit.

- Does not need money - No successful trader trades today with money that may be needed tomorrow. In other words, by trading forex, you deprive yourself of a certain amount of money for a certain period of time. A successful trader in the market does not need to trade positive today to pay utility bills tomorrow.

- Know when to stop - All successful traders understand when it`s time to stop trading and take a break. Surely you know how difficult it is to leave the market, nevertheless it is necessary. Sometimes there are situations when emotions run high and overcome us. That is why a break in trading can be extremely beneficial.

- Don`t get hung up on winning or losing trades - Everyone likes to win, and advertising exploits our desire to always be right. Few people will click on an ad if they see that the ad promises a 10% return. However, successful traders know that the key is to maximize the amount of money earned on wins and minimize the amount of money lost on losses.

- Don`t give up - While this is the last rule on the list, it is by far the most important to your success as a trader. The only way to fail in trading is to stop fighting. Only perseverance will lead you to success.

The most important takeaway from today`s article is that there is no secret to successful forex trading. Undoubtedly, there are various tips that can help you. However, those traders who have managed to achieve stable profits do nothing out of the ordinary. In other words, you are quite capable of doing everything they do.

However, if you are determined to join the top 5% of successful traders, you must be prepared for hard work. There is no finish line in this race.